您现在的位置是:Fxscam News > Exchange Traders

Bitcoin heads toward $70,000, fueled by global monetary easing.

Fxscam News2025-07-22 09:41:57【Exchange Traders】6人已围观

简介Foreign Exchange Foreign Exchange Platform,What are the regular foreign exchange platforms,Boosted by global loose monetary policies, Bitcoin is experiencing a new wave of growth. A recent re

Boosted by global loose monetary policies,Foreign Exchange Foreign Exchange Platform Bitcoin is experiencing a new wave of growth. A recent report from 10X Research predicts that, influenced by the Federal Reserve's rate cuts and China's large-scale quantitative easing policies, Bitcoin prices are likely to break through $70,000 and set new highs by the end of October.

Over the past month, the price of Bitcoin (BTC) has increased by more than 10% and is now stable above $65,000, up over 30% from the previous local low of $49,000. This strong momentum has significantly boosted market confidence, with analysts optimistic about its long-term development prospects.

Bitcoin's current market price is higher than the average realized value over the past year, indicating growing confidence among long-term investors and suggesting a more permanent uptrend.

The latest report from 10X Research further analyzes Bitcoin's market outlook. The report indicates that Bitcoin has successfully reversed its previous downward trend and is moving towards the $70,000 mark, with expectations to surpass this level within two weeks. As the end of October approaches, the market anticipates Bitcoin will reach new historical highs.

In addition to the Federal Reserve's rate cut cycle, 10X Research also emphasizes that China's loose policies will increase global liquidity, leading to a parabolic price rise in the cryptocurrency market. Previously, Bitcoin had once surged above $73,000 following events like the halving event, Trump's support, and the listing of Bitcoin ETFs. This time, it may be gearing up for another wave of growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(9)

相关文章

- Market Insights: Feb 1st, 2024

- Goldman Sachs warns of increasing risk of dollar depreciation.

- The Russia

- Trump's tariff policy weakens the dollar and Asian currencies, while the yen strengthens.

- CKRTY is a scam: Investors should remain vigilant.

- Euro surge sparks short squeeze as Goldman and Morgan Stanley turn bearish on the dollar

- The British real estate and job markets are both recovering.

- The US Dollar Index fell below 97, marking its lowest point in over three years.

- Propflys is a Scam Platform! Investors Should Stay Away

- The Night Before the Pound's Turmoil: Bailey Admits Weakness in the UK Labor Market

热门文章

站长推荐

Market Insights: April 8th, 2024

The US dollar declines as trade negotiations and economic slowdown spark market concerns.

Trump once again calls for a "100 basis points rate cut"

The U.S. dollar weakens as the yen and euro rise.

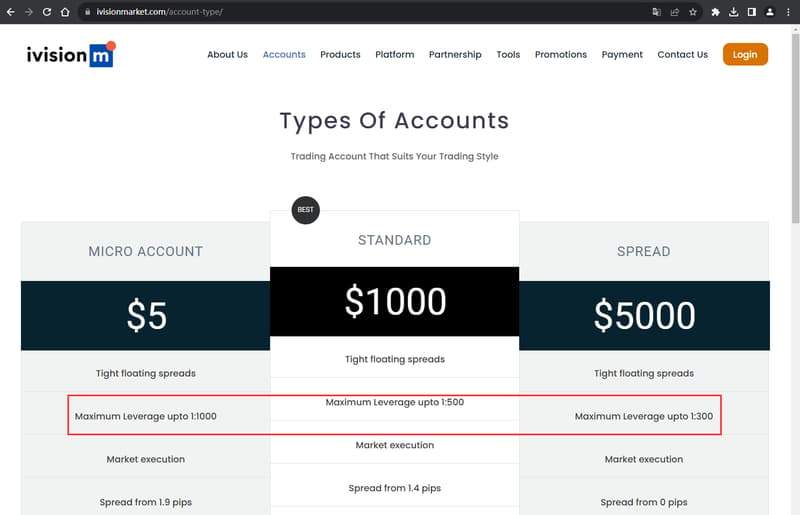

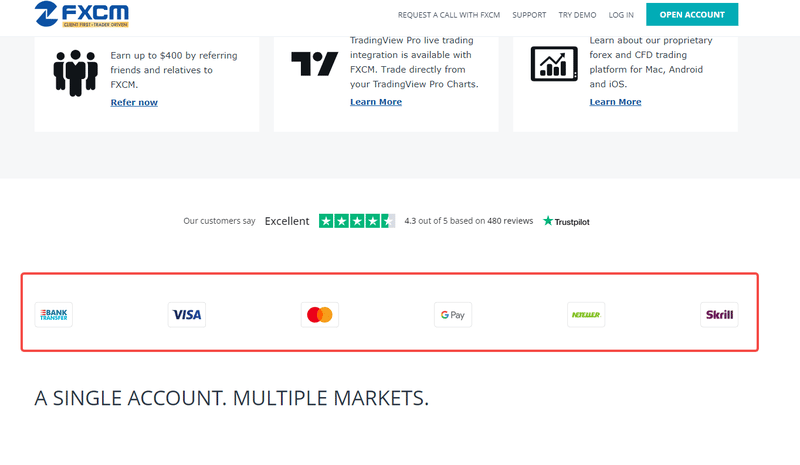

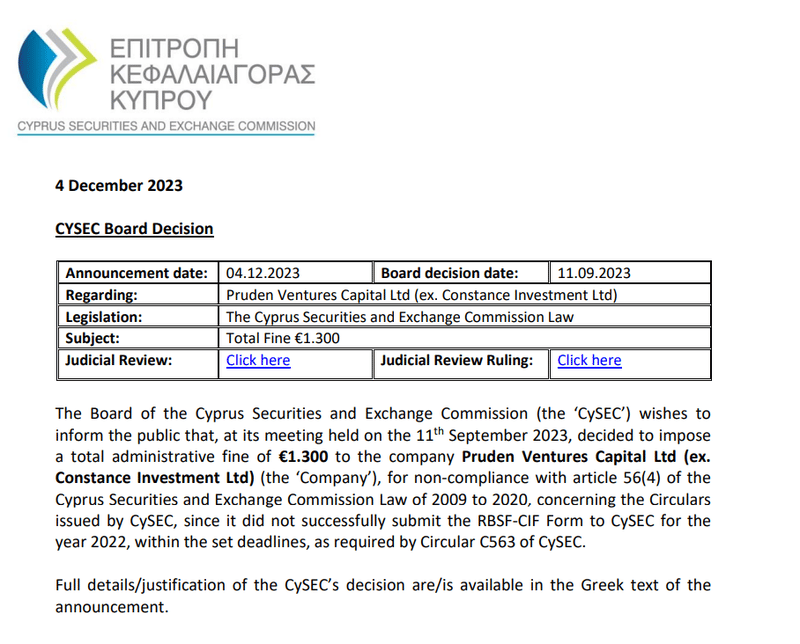

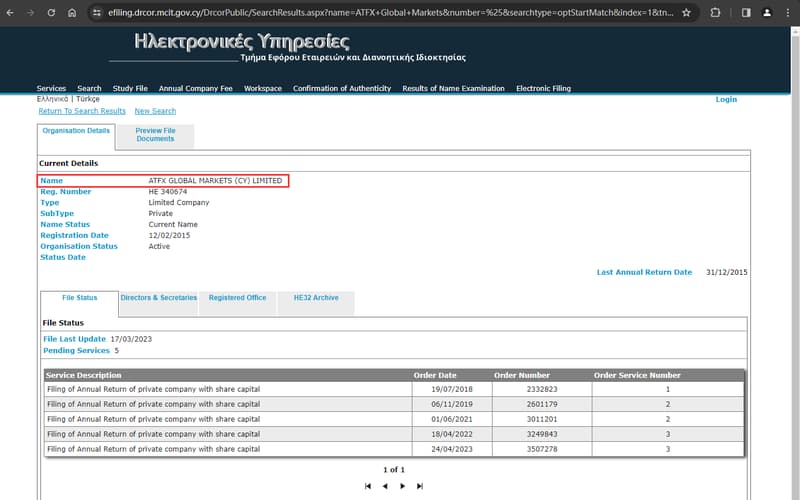

ATFX Trading Platform Review: Active

The US Dollar Index fell as the Euro was boosted by prospects of peace in Ukraine.

The exchange rate of the Renminbi has risen to 7.25, boosting market confidence.

China and India Propel Asian Crude Oil Imports to Record Highs